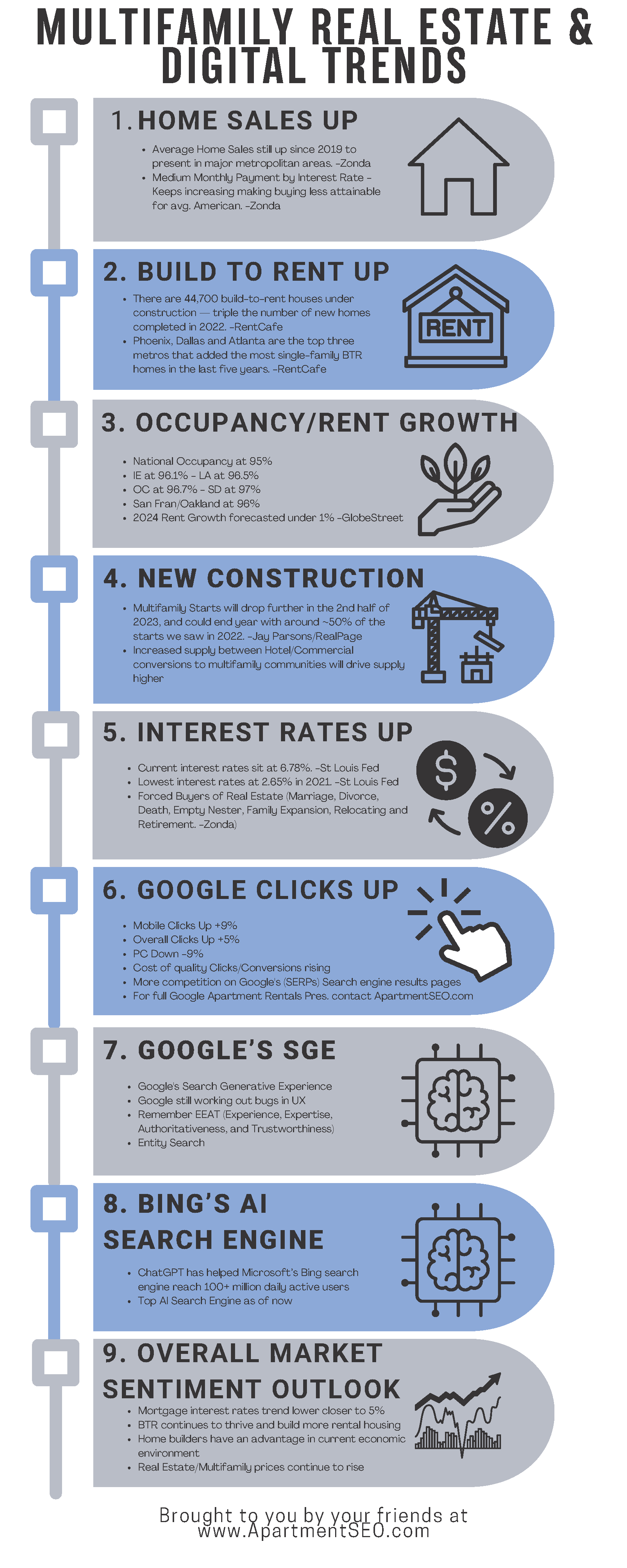

Multifamily Real Estate And Digital Trends

- Home Sales Up

- Average Home Sales are still up from 2019 to the present in major metropolitan areas. -Zonda

- Medium Monthly Payment by Interest Rate – Keeps increasing, making buying less attainable for avg. American. -Zonda

- Build to Rent Up

- There are 44,700 build-to-rent houses under

construction — triple the number of new homes

completed in 2022. -RentCafe - Phoenix, Dallas, and Atlanta are the top three

metros that added the most single-family BTR

homes in the last five years. -RentCafe

- There are 44,700 build-to-rent houses under

- Occupancy Rent Growth

- National Occupancy at 95%

- IE at 96.1% – LA at 96.5%

- OC at 96.7% – SD at 97%

- San Fran/Oakland at 96%

- 2024 Rent Growth forecasted under 1% -GlobeStreet

- New Construction

- Multifamily Starts will drop further in the 2nd half of

2023, and could end the year with around ~50% of the

starts we saw in 2022. -Jay Parsons/RealPage - Increased supply between Hotel/Commercial

conversions with multifamily communities will drive the supply

higher.

- Multifamily Starts will drop further in the 2nd half of

- Interests Rates Up

- Current interest rates sit at 6.78%. -St Louis Fed

- Lowest interest rates at 2.65% in 2021. -St Louis Fed

- Forced Buyers of Real Estate (Marriage, Divorce,

Death, Empty Nester, Family Expansion, Relocating and

Retirement. -Zonda)

- Google Clicks Up

- Mobile Clicks Up +9%

- Overall Clicks Up +5%

- PC Down -9%

- Cost of quality Clicks/Conversions rising

- More competition on Google’s (SERPs) Search engine results pages

- For full Google Apartment Rentals Pres. contact ApartmentSEO.com

- Google’s SGE

- Google’s Search-Generative Experience

- Google still working out bugs in UX

- Remember EEAT (Experience, Expertise,

Authoritativeness and Trustworthiness) - Entity Search

- Bing’s AI Engine Search

- ChatGPT has helped Microsoft’s Bing search

engine reaches 100+ million daily active users - Top AI Search Engine as of now

- ChatGPT has helped Microsoft’s Bing search

- Overall Market Sentiment Outlook

- Mortgage interest rates trend lower, closer to 5%

- BTR continues to thrive and build more rental housing

- Home builders have an advantage in the current economic

environment - Real Estate/Multifamily prices continue to rise